Save 10% on All AnalystPrep 2024 Study Packages with Coupon Code BLOG10.

- Payment Plans

- Product List

- Partnerships

- Tutoring

- Pricing

- Payment Plans

- Product List

- Partnerships

- Tutoring

- Pricing

- Try Free Trial

- Try Free Trial

Back

CFA® Exam

Level I

- Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Level II

- Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Level III

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

- Mock Exams

ESG

- Study Packages

- Study Notes

- Practice Questions

- Mock Exams

Back

FRM® Exam

Exam Details

- About the Exam

- About your Instructor

Part I

- Part I Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Part II

- Part II Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Back

Actuarial Exams

Exams Details

- About the Exam

- About your Instructor

Exam P

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

Exam FM

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

Back

Graduate Admission

GMAT® Focus Exam

- Study Packages

- About the Exam

- Video Lessons

- Practice Questions

- Quantitative Questions

- Verbal Questions

- Data Insight Questions

- Live Tutoring

Executive Assessment®

- Study Packages

- About the Exam

- About your Instructors

- Video Lessons

- EA Practice Questions

- Quantitative Questions

- Data Sufficiency Questions

- Verbal Questions

- Integrated Reasoning Questions

GRE®

- Study Packages

- About the Exam

- Practice Questions

- Video Lessons

cfa-level-iii

01 Nov 2023

This section builds upon the previous concept of the ‘u-shape’change in tracking error – the initial improvement and subsequent reversal of tracking error as more index securities are added to a portfolio. Several factors contribute to tracking error:

- Management fees: These fees are incurred in creating and managing the portfolio. The index composition doesn't account for fees, leading to a discrepancy.

- Commissions: While compiling an index doesn't involve commissions, building a real portfolio does. This introduces a divergence, resulting in tracking error.

- Less liquid securities: Trading fewer liquid securities increases trading costs, leading to tracking error.

- Day trading: Indices feature securities priced at the day's end. Intra-day transactions occur at various points, potentially deviating from the end-of-day price and causing a disconnect between portfolio and index performance.

- Cash drag: An index is inherently ‘fully invested in itself’ without the need for cash. Real portfolios often hold cash due to inflows and redemptions, creating differences from the index.

Controlling Tracking Error

Managing tracking error involves balancing the trade-offs between staying faithful to a benchmark index and the associated costs. In an ideal scenario, portfolio managers would closely match the number of constituent securities and their weights with the benchmark index. However, real-world factors like trading costs and fees lead to deviations in actual investment performance compared to the index.

Passive investing doesn't mean no trading activity. Managers engage in trading to manage cash flows, reinvest dividends, and adjust for changes in the index's constituents. It's common for passive portfolio managers to minimize cash holdings because having cash can lead to unwanted tracking error. To reduce tracking error, portfolio managers aim to invest cash flows at valuations similar to those used by the benchmark index provider. When that's not possible, they strive to maintain a beta of 1.0 relative to the benchmark index while aligning other risk factor exposures with the index.

Question

Less liquid securities create tracking error in a passively managed portfolio by:

- Increasing cash drag.

- Increasing management fees.

- Increasing trading costs.

Solution

The correct answer is C.

Less liquid securities can contribute to tracking error in a passively managed portfolio by increasing trading costs. When you need to buy or sell less liquid securities, you may face wider bid-ask spreads and experience difficulty in executing large orders without affecting the market price. The higher trading costs associated with these challenges can lead to deviations from the target benchmark index, creating tracking error.

A is incorrect. Less liquid securities can indeed contribute to tracking error, but it's not because they directly increase cash drag. Cash drag refers to the portion of the portfolio that is held in cash or cash equivalents and is not invested in securities that track the benchmark index. It can result from having cash on hand due to inflows, outflows, or other reasons. Less liquid securities may indirectly contribute to cash drag if trading them is difficult or costly, but the primary impact is on trading costs, not cash drag.

B is incorrect. Less liquid securities do not directly impact management fees. Management fees are typically fixed or based on the assets under management, and they are not directly related to the liquidity of the securities in the portfolio. Management fees represent the costs charged by the fund manager for managing the portfolio but are not influenced by the liquidity of the underlying securities.

Reading 24: Passive Equity Investing

Los 24 (e) Discuss potential causes of tracking error and methods to control tracking error for passively managed equity portfolios

Shop CFA® Exam Prep

Offered by AnalystPrep

Level I

Level II

Level III

All Three Levels

Featured

View More

Shop FRM® Exam Prep

FRM Part I

FRM Part II

Learn with Us

Shop Actuarial Exams Prep

Exam P (Probability)

Exam FM (Financial Mathematics)

Shop Graduate Admission Exam Prep

GMAT Focus

Executive Assessment

GRE

Daniel Glyn

2021-03-24

I have finished my FRM1 thanks to AnalystPrep. And now using AnalystPrep for my FRM2 preparation. Professor Forjan is brilliant. He gives such good explanations and analogies. And more than anything makes learning fun. A big thank you to Analystprep and Professor Forjan. 5 stars all the way!

michael walshe

2021-03-18

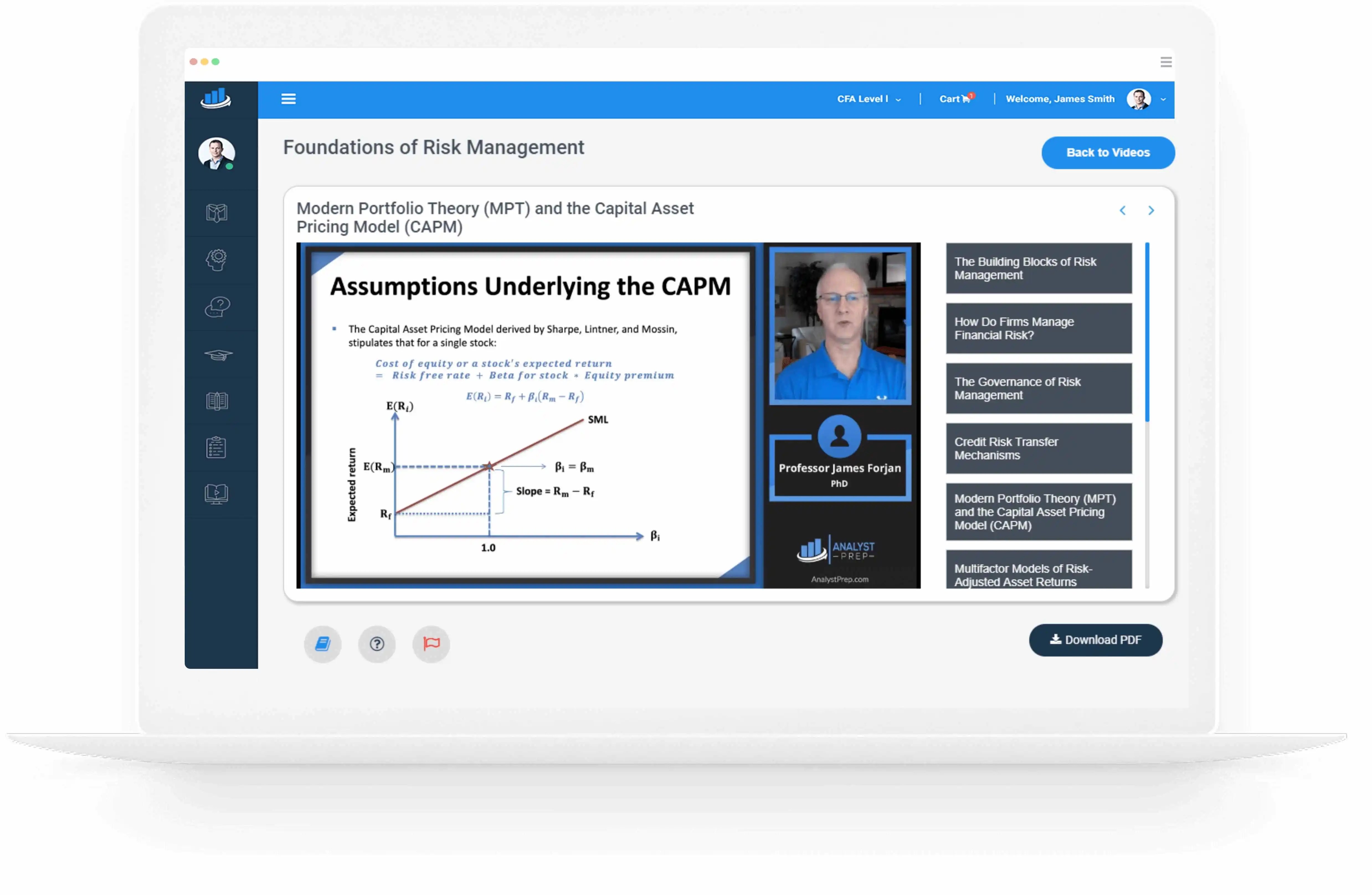

Professor James' videos are excellent for understanding the underlying theories behind financial engineering / financial analysis. The AnalystPrep videos were better than any of the others that I searched through on YouTube for providing a clear explanation of some concepts, such as Portfolio theory, CAPM, and Arbitrage Pricing theory. Watching these cleared up many of the unclarities I had in my head. Highly recommended.

Nyka Smith

2021-02-18

Every concept is very well explained by Nilay Arun. kudos to you man!

Badr Moubile

2021-02-13

Very helpfull!

Agustin Olcese

2021-01-27

Excellent explantions, very clear!

Jaak Jay

2021-01-14

Awesome content, kudos to Prof.James Frojan

sindhushree reddy

2021-01-07

Crisp and short ppt of Frm chapters and great explanation with examples.

Trustpilot rating score: 4.7 of 5, based on 61 reviews.

Related Posts