Save 10% on All AnalystPrep 2024 Study Packages with Coupon Code BLOG10.

- Payment Plans

- Product List

- Partnerships

- Tutoring

- Pricing

- Payment Plans

- Product List

- Partnerships

- Tutoring

- Pricing

- Try Free Trial

- Try Free Trial

Back

CFA® Exam

Level I

- Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Level II

- Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Level III

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

- Mock Exams

ESG

- Study Packages

- Study Notes

- Practice Questions

- Mock Exams

Back

FRM® Exam

Exam Details

- About the Exam

- About your Instructor

Part I

- Part I Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Part II

- Part II Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Back

Actuarial Exams

Exams Details

- About the Exam

- About your Instructor

Exam P

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

Exam FM

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

Back

Graduate Admission

GMAT® Focus Exam

- Study Packages

- About the Exam

- Video Lessons

- Practice Questions

- Quantitative Questions

- Verbal Questions

- Data Insight Questions

- Live Tutoring

Executive Assessment®

- Study Packages

- About the Exam

- About your Instructors

- Video Lessons

- EA Practice Questions

- Quantitative Questions

- Data Sufficiency Questions

- Verbal Questions

- Integrated Reasoning Questions

GRE®

- Study Packages

- About the Exam

- Practice Questions

- Video Lessons

financial-reporting-and-analysis

05 Mar 2020

Cash flow from Operating Activities may be reported in either presentation format: the direct method and the indirect method.

Both IFRS and US GAAP encourage the use of the direct method but will allow either method to be used. Under US GAAP, however, companies must present a reconciliation between net income and cash flow when they use the direct method. Ironically, this is equivalent to the indirect method.

Irrespective of the method used to prepare the cash flow from the operating activities section of the cash flow statement, the cash flow from investing and financing activities is each prepared using one format only.

The Direct Method

In the direct method, each cash inflow and cash outflow related to cash receipts and payments are shown, while the impact of accruals is eliminated.

The primary argument favoring the direct method is that it provides information on the specific sources of operating cash receipts and payments. This information can be useful in understanding a company’s historical performance and capacity to repay existing obligations. In addition, the direct method can be useful in the prediction of the future financing needs of a company.

Below, you will find an example of the cash flow from the operations segment of a cash flow statement prepared under IFRS using the direct method:

$$ \begin{array}{l|r|r} \text{} & \bf {\text{Dec }31,2016} & \bf {\text{Dec }31,2015} \\ \text{} & \bf{$} & \bf{$} \\ \hline \textbf{Cash flow from operating activities} & {} & {} \\ {\quad \quad \text{Cash received from customers}} & {25,900} & {23,478} \\ {\quad \quad \text{Cash paid to suppliers and employees}} & {-15,658} & {-17,534} \\ {\quad \quad \text{Dividend received}} & {1,200} & {178} \\ {\quad \quad \text{Net interest and other financial expenses paid}} & {-5,426} & {-4,789} \\ {\quad \quad \text{Taxes paid}} & {\underline {-1963} } & {\underline {-750}} \\ \textbf{Net cash from operating activities} & {{\bf{4,053}}} & {{\bf{583}}} \\ \end{array} $$

The Indirect Method

The indirect method only provides the net results of receipts and payments. Net income, the starting point for the Indirect method, is reconciled with cash flow from operations after making adjustments for non-cash items, non-operating items, and net changes in operating accruals.

The main arguments in support of the indirect method are:

- the method shows the reasons for differences between net income and operating cash flows;

- the method mirrors a forecasting approach. It commences with forecasting future income and then derives cash flows by adjusting for changes in balance sheet accounts. The changes in balance sheet accounts are attributed to timing differences between accrual accounting and cash accounting; and

- adjusting net income to operating cash flows is easier and less costly than reporting gross operating cash receipts and payments, which is the case with the direct method.

Below is an example of the cash flow from the operations segment of a cash flow statement prepared under IFRS using the indirect method:

$$ \begin{array}{l|r|r} {} & {\bf{\text{Dec }31,2016}} & {\bf{\text{Dec }31,2015 }} \\ {} & {\bf{$}} & {\bf{ $} }\\ \hline {\textbf{Cash flow from operating activities}} & {} & {} \\ {\text{Net profit}} & {3,457} & {4,256} \\ {\quad \quad {\text{Taxation}}} & {1,200} & {1,189} \\ {\quad \quad {\text{Net finance costs}}} & {536} & {245} \\ {\text{Operating profit}\text{ (continued and discontinued operations}) }& {5,193} & {5,690} \\ {\quad \quad \text{Depreciation, amortization and impairment}} & {1,028} & {1,001} \\ {\quad \quad \text{Changes in working capital}} & {1,517} & {1,501} \\ {\quad \quad \quad \quad \text{Inventories}} & {245} & {657} \\ {\quad \quad \quad \quad \text{Trade and other receivables}} & {536} & {426} \\ {\quad \quad \quad \quad \text{Trade payable and other current liabilities}} & {736} & {418} \\ {\quad \quad \text{Provision less payments}} & {-275} & {-74} \\ {\quad \quad { \text{Elimination of profits or losses on disposals} } } & {54} & {-1,567} \\ {\quad \quad \text{Non cash charge for share base compensation}} & {167} & {195} \\ {\quad \quad \text{Other adjustments}} & {17} & {32} \\ {\textbf{Cash flow from operating activities}} & {\overline {\bf{7,701}}} & {\overline {\bf {6,778}}} \\ \end{array} $$

Question 1

Which of the following is least likely to be shown in the cash flow from operations section of the cash flow statement using the indirect method?

- Net profit.

- Cash received from clients.

- Changes in working capital.

Solution

The correct answer is B.

Cash received from clients is not reflected under the indirect method. Net profit and changes in working capital are usually reflected.

Question 2

Which of the below sections would differ between cash flow statement prepared using the direct method, and another prepared using the indirect method?

- Investing cash flow.

- Financing cash flow.

- Operating cash flow.

Solution

The correct answer is C.

The only difference between the two methods is how they report operating cash flow. The indirect method starts with net income, then deducts/adds non-cash items. The direct method shows cash inflows and outflows directly.

Shop CFA® Exam Prep

Offered by AnalystPrep

Level I

Level II

Level III

All Three Levels

Featured

View More

Shop FRM® Exam Prep

FRM Part I

FRM Part II

Learn with Us

Shop Actuarial Exams Prep

Exam P (Probability)

Exam FM (Financial Mathematics)

Shop Graduate Admission Exam Prep

GMAT Focus

Executive Assessment

GRE

Sergio Torrico

2021-07-23

Excelente para el FRM 2Escribo esta revisión en español para los hispanohablantes, soy de Bolivia, y utilicé AnalystPrep para dudas y consultas sobre mi preparación para el FRM nivel 2 (lo tomé una sola vez y aprobé muy bien), siempre tuve un soporte claro, directo y rápido, el material sale rápido cuando hay cambios en el temario de GARP, y los ejercicios y exámenes son muy útiles para practicar.

diana

2021-07-17

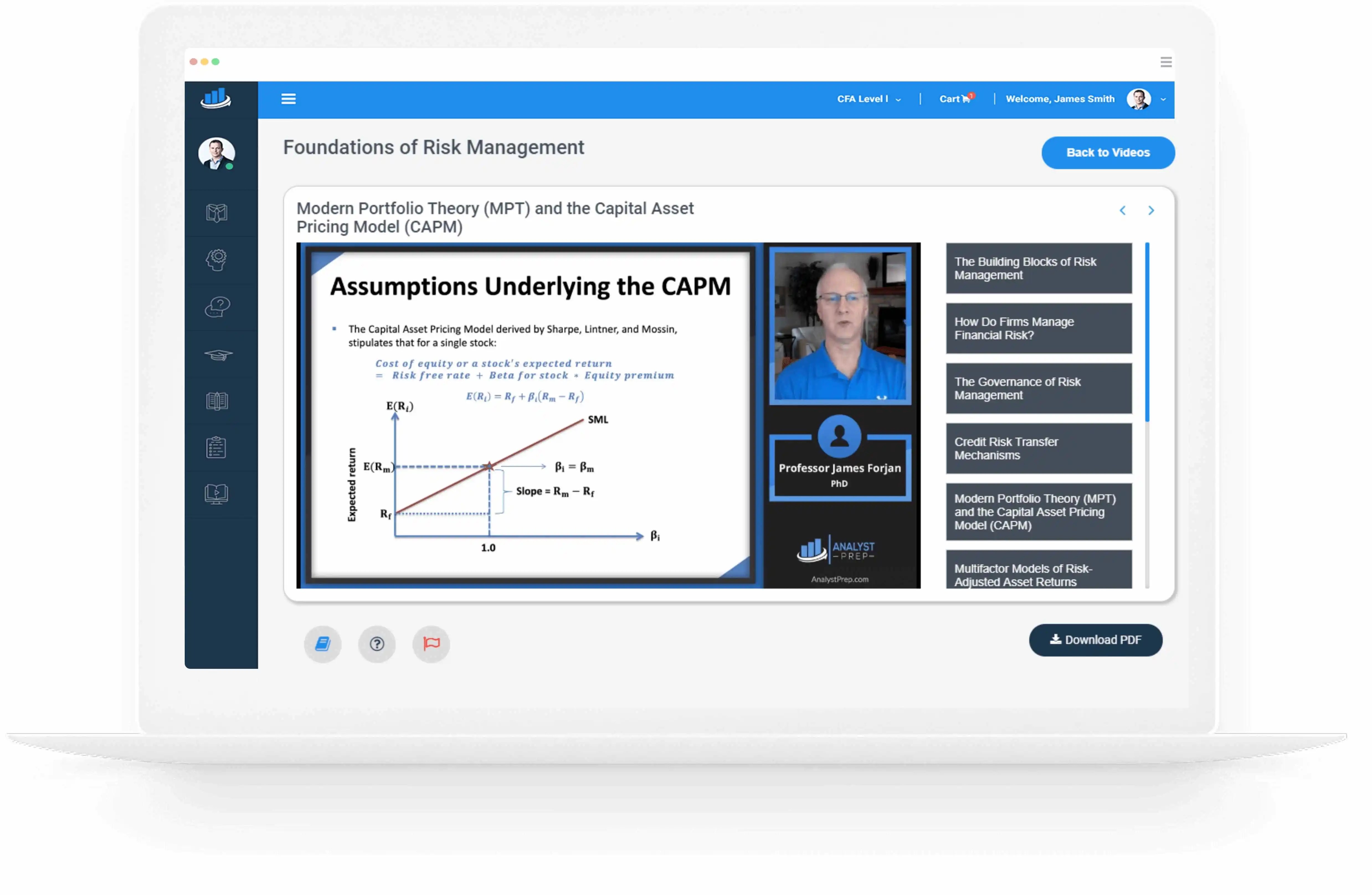

So helpful. I have been using the videos to prepare for the CFA Level II exam. The videos signpost the reading contents, explain the concepts and provide additional context for specific concepts. The fun light-hearted analogies are also a welcome break to some very dry content.I usually watch the videos before going into more in-depth reading and they are a good way to avoid being overwhelmed by the sheer volume of content when you look at the readings.

Kriti Dhawan

2021-07-16

A great curriculum provider. James sir explains the concept so well that rather than memorising it, you tend to intuitively understand and absorb them. Thank you ! Grateful I saw this at the right time for my CFA prep.

nikhil kumar

2021-06-28

Very well explained and gives a great insight about topics in a very short time. Glad to have found Professor Forjan's lectures.

Marwan

2021-06-22

Great support throughout the course by the team, did not feel neglected

Benjamin anonymous

2021-05-10

I loved using AnalystPrep for FRM. QBank is huge, videos are great. Would recommend to a friend

Daniel Glyn

2021-03-24

I have finished my FRM1 thanks to AnalystPrep. And now using AnalystPrep for my FRM2 preparation. Professor Forjan is brilliant. He gives such good explanations and analogies. And more than anything makes learning fun. A big thank you to Analystprep and Professor Forjan. 5 stars all the way!

michael walshe

2021-03-18

Professor James' videos are excellent for understanding the underlying theories behind financial engineering / financial analysis. The AnalystPrep videos were better than any of the others that I searched through on YouTube for providing a clear explanation of some concepts, such as Portfolio theory, CAPM, and Arbitrage Pricing theory. Watching these cleared up many of the unclarities I had in my head. Highly recommended.

Trustpilot rating score: 4.5 of 5, based on 69 reviews.

Related Posts